are assisted living expenses tax deductible in 2019

Which means a doctor or nurse with. Yes in certain instances nursing home expenses are deductible medical expenses.

Assisted living expenses qualify as deductible medical expenses when the.

. Often times the assisted living facility can provide a breakdown of which fees are considered eligible for medical deductions. Unfortunately many people do not realize that. Tax deductions are available to anyone in assisted living who has been diagnosed as chronically ill.

Conditions to Be Met for Senior Living Medical Expenses to Be Tax-Deductible. Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. If a loved one needs to move into an assisted living facility to recover from an illness or an injury and requires only observational or custodial.

Medical expenses including some long-term care expenses are deductible if they exceed 10 of your gross income in 2019. 100 Free Federal for Old Tax Returns. As we mentioned earlier in order for any of your assisted living expenses to be considered tax-deductible medical expenses they must exceed the IRSs threshold of 0075 or.

Special rules when claiming the disability amount. In order for assisted living. Custodial Care Partial Deduction.

Medical expenses including some long-term care expenses are deductible if the expenses are more than 75 percent of your adjusted gross income. There are special rules when claiming the disability amount and attendant care as medical expenses. Unfortunately not all assisted living costs have the possibility of being deducted however if you are living in a community dedicated to assisted living some of.

In order for assisted living expenses to be tax deductible the. According to the Internal Revenue Service IRS taxpayers are allowed to deduct the cost of assisted living partially or in full if you qualify. Caregivers who meet those requirements.

Your emergency fund can help you as you adjust to your budget. Obviously your own medical expenses are tax deductible and the same for your spouse and children. Ad Prepare your 2019 state tax 1799.

Assisted Living for a Qualifying Relative. An assisted living resident can. To qualify for these deductions caregivers must be able to claim that senior as a dependent and be paying for at least 50 of their living expenses.

Common Health Medical Tax Deductions For Seniors. Find Fresh Content Updated Daily For Tax deductions for assisted living. Health fees from overseas can only be tax deductible if they are from a public university or public hospital.

If you your spouse or your dependent is in a nursing home primarily for medical care then the. For information on claiming. As mentioned earlier medical expenses for senior living may be tax-deductible if specific.

Chronic Illness and Tax Deductible Status. Yes medical expenses in excess of 10 of gross annual income may be deducted from your income taxes. Contact the facility and request a.

The Health Insurance Portability and Accountability Act also known as HIPPA directs that qualified long-term care services are tax deductible. Everything is included Prior Year filing IRS e-file and more. You can also subtract the.

/GettyImages-578806154-725660e4d06244d9a835b95af2651599.jpg)

Things Nursing Homes Are Not Allowed To Do

Health Care And Your Taxes What S The Connection Turbotax Tax Tips Videos

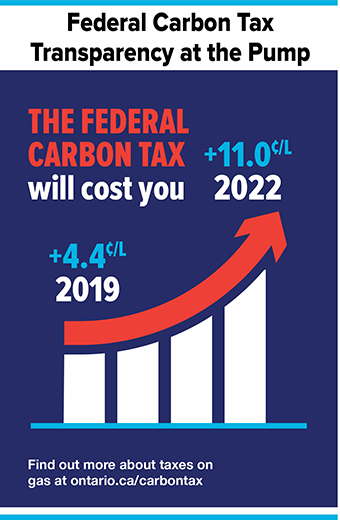

2019 Ontario Budget Chapter 1d

Is Long Term Care Insurance Tax Deductible Goodrx

Government Grants For Seniors Senior Benefits Canada Homeequity Bank

2019 Ontario Budget Chapter 1d

2019 Ontario Budget Chapter 1d

2019 Ontario Budget Chapter 1d

2019 Ontario Budget Chapter 1d

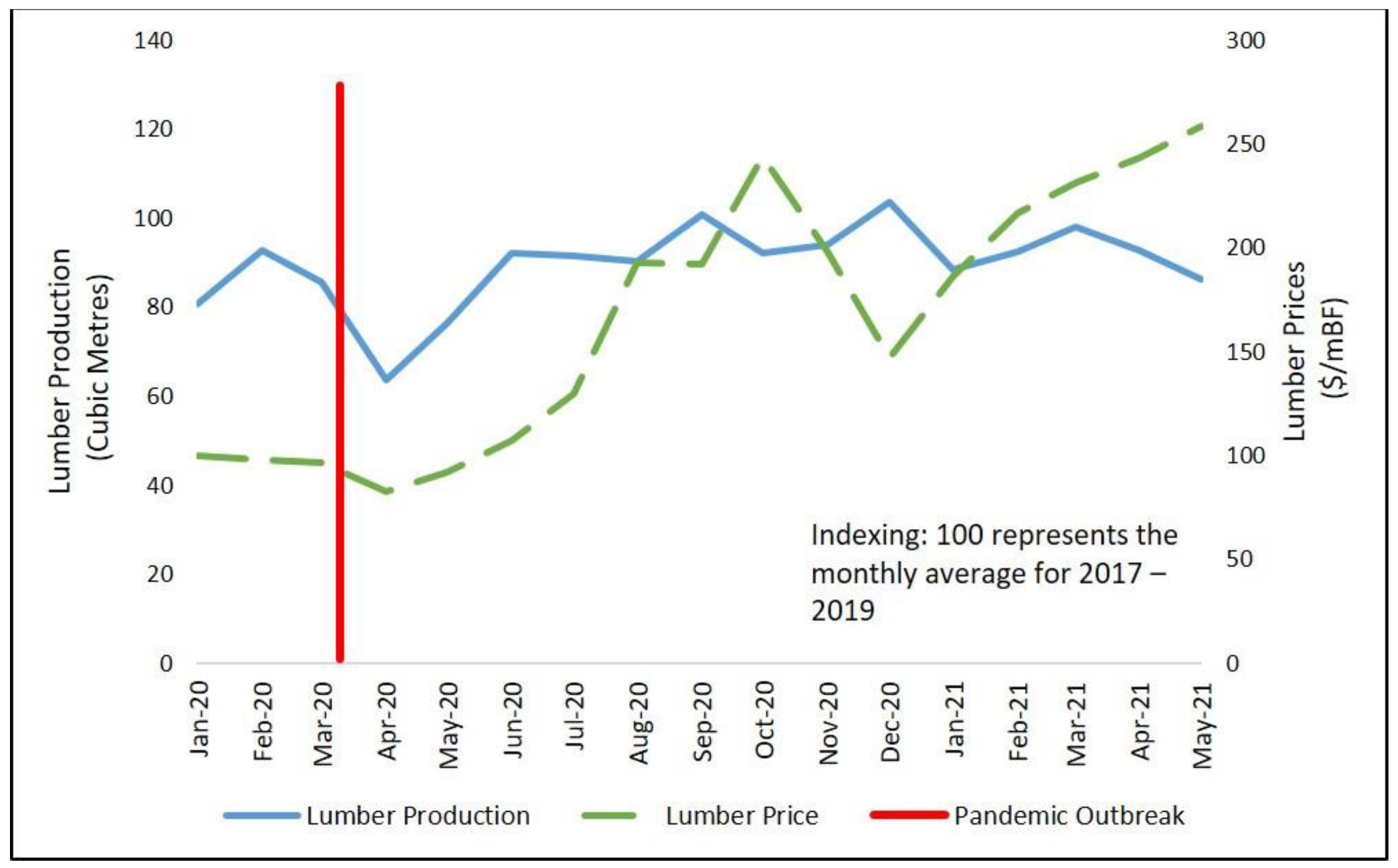

Energies Free Full Text Impact Of The Covid 19 Pandemic On Biomass Supply Chains The Case Of The Canadian Wood Pellet Industry Html

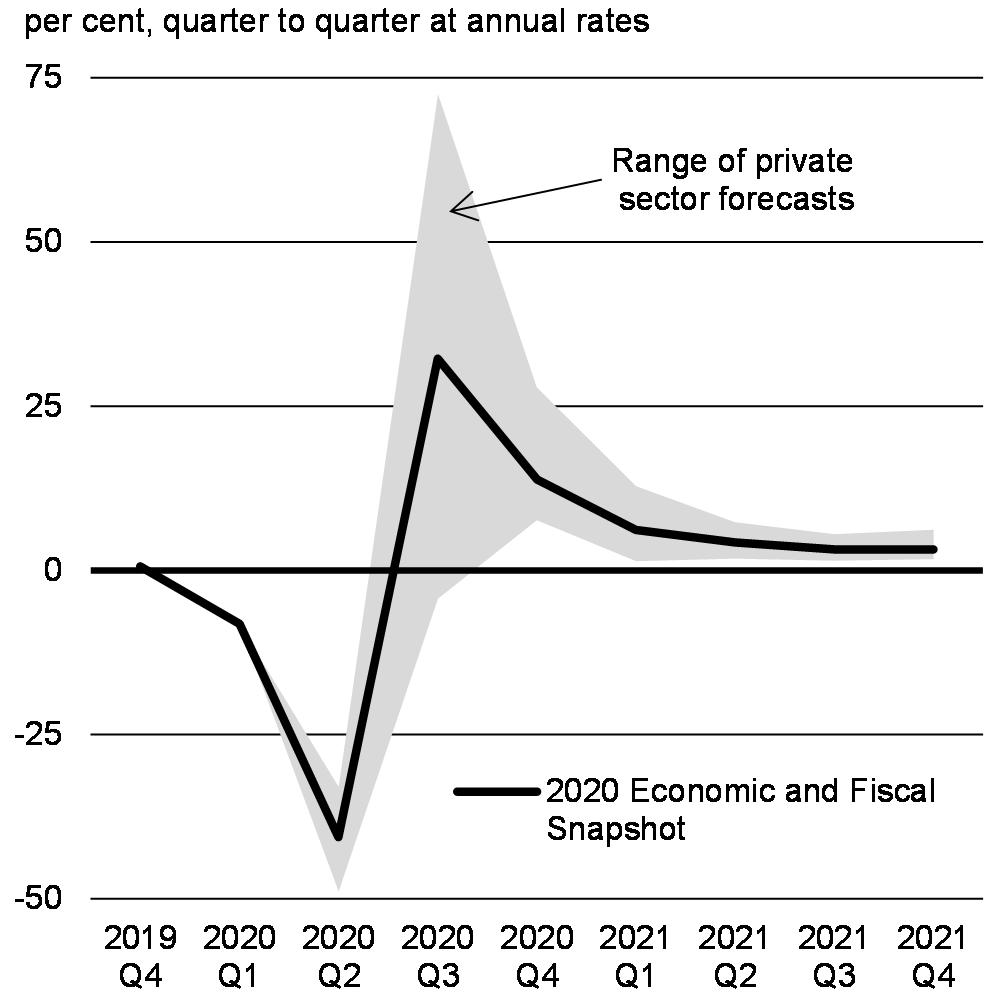

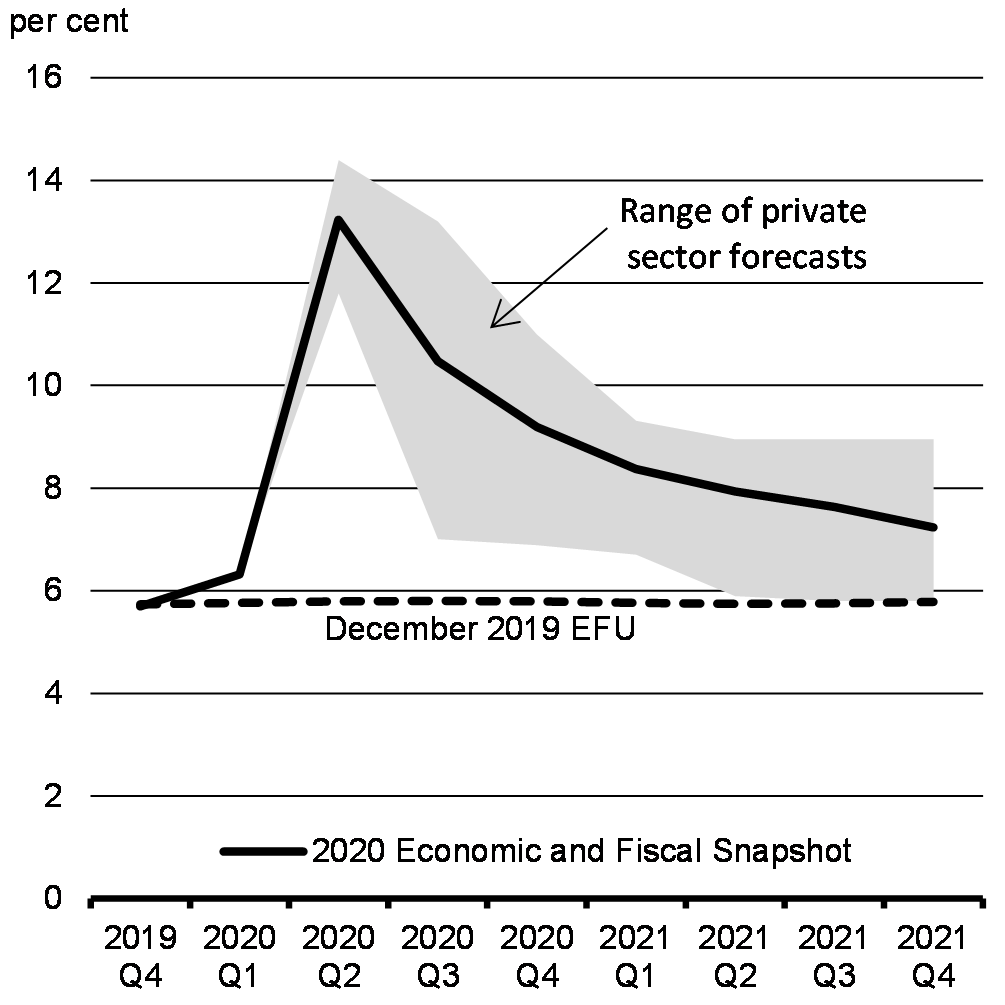

Details Of Economic And Fiscal Projections Canada Ca

2019 Ontario Budget Chapter 1d